Questions Financial Planners Will Ask You

Nobody truly likes budgeting, but financial planners will tell you it's crucial to your financial health. And if buying your own home is going to be a part of your overall financial plan, you should listen and pay attention to what financial planners say.

I've known and worked with many financial planners during my career, and it never fails to amaze me that almost always they will begin to form a relationship with prospective clients the exact same way that I do - by asking questions. After all, it doesn't make any sense to just start spouting information and knowledge at someone, because that will almost guarantee you'll lose that prospective client. That's not what building relationships is all about. Building relationships takes time and effort, and in simple terms, trying to fit yourself into the prospective client's shoes, into their lifestyle, into their mindset. And you simply can't do that without asking questions.

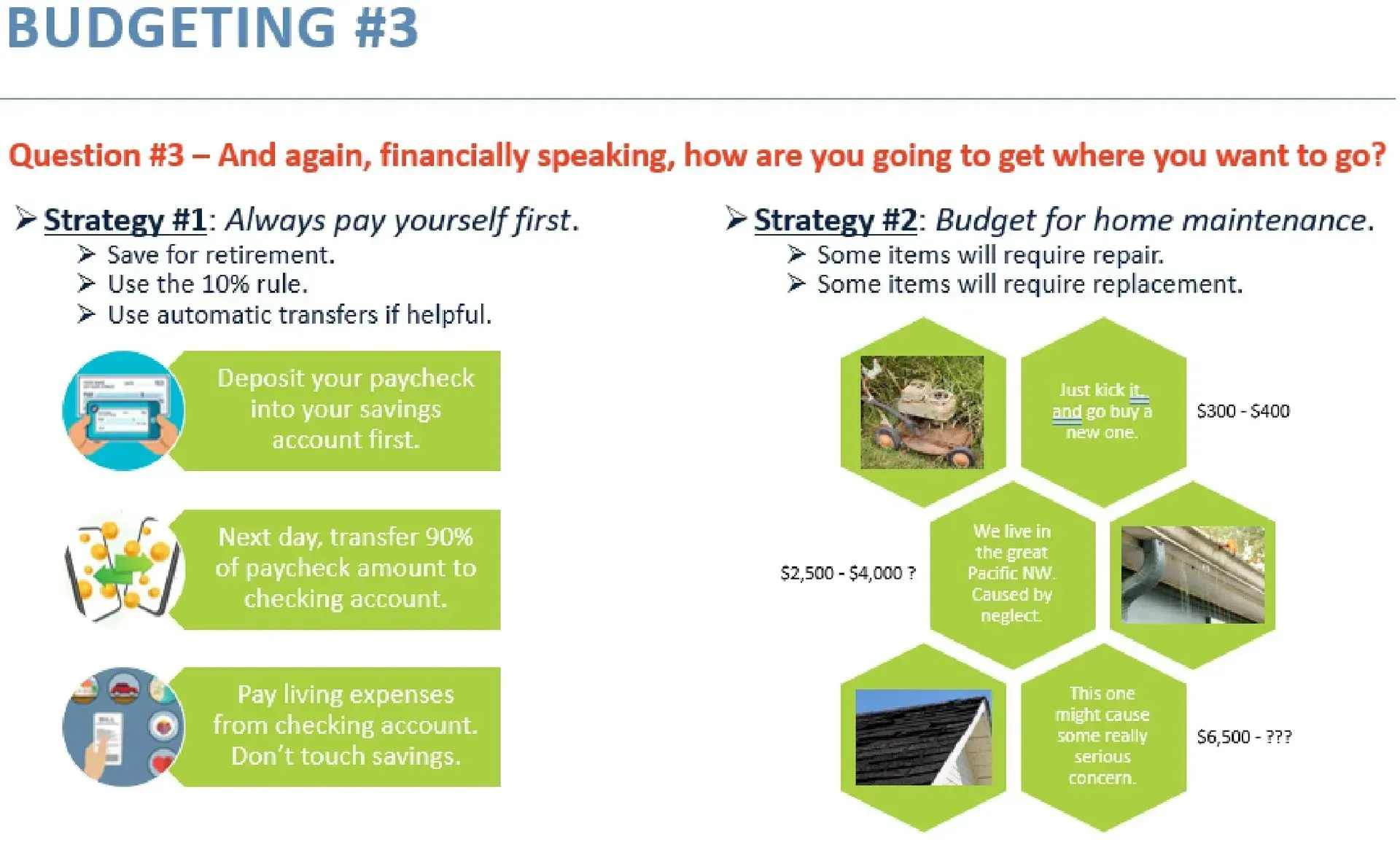

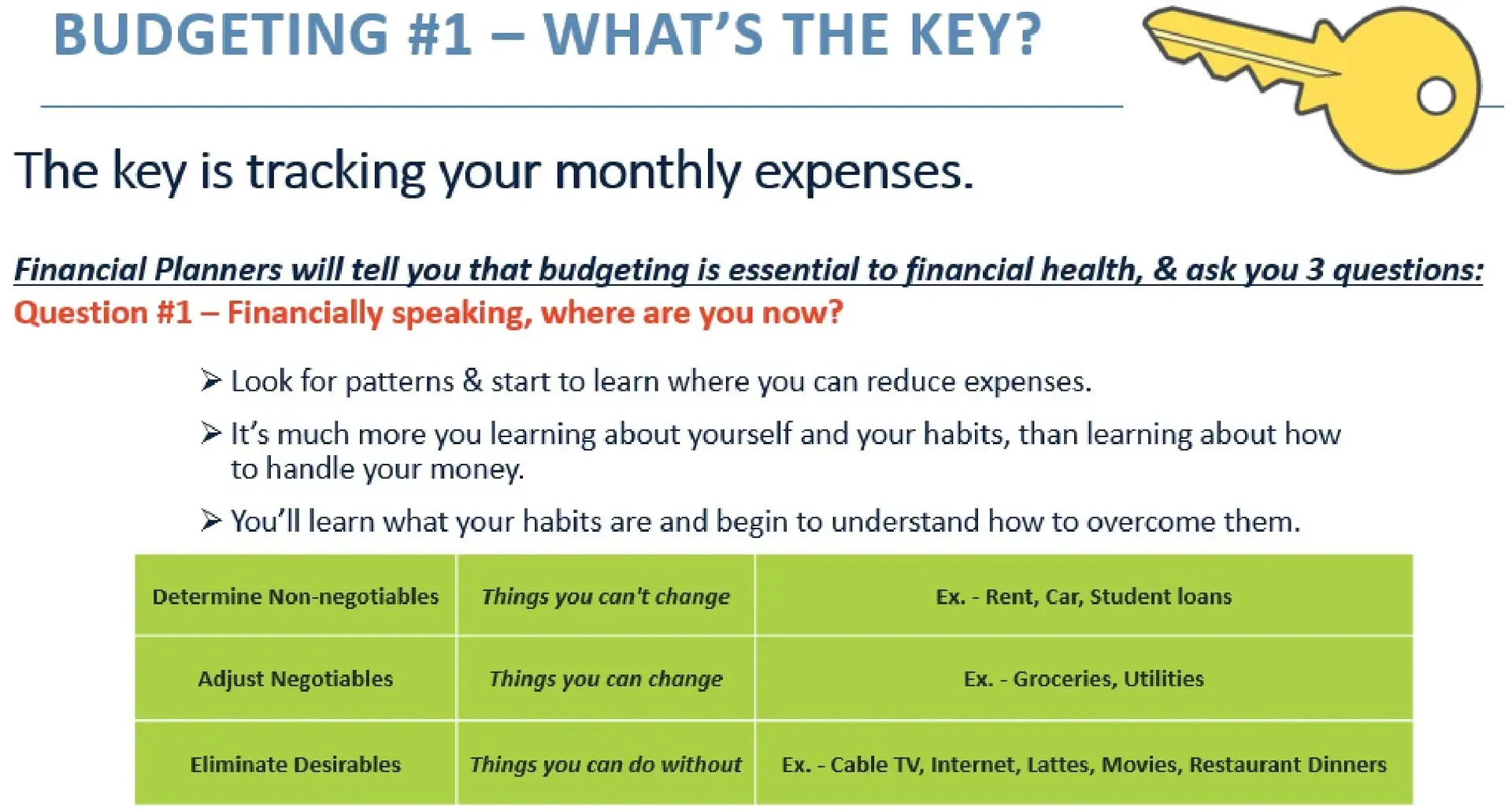

Whether or not your financial plans include owning real estate, financial planners will usually start with the same question - "Financially speaking, where are you now?" And your answers might include a quick review of how much you have in the way of assets, what your credit scores might be, what your long-term employment prospects are, an idea of when you want to retire, do you want to travel the world in your retirement years, etc. When you begin providing those kinds of answers, the financial planner will begin to "see into your lifestyle". And once you've decided to work with a financial planner, they'll do the same thing that many good real estate brokers and mortgage professionals do, which is to help you see and clearly understand your relationship with your money. Make no mistake about it, you have a relationship with your money. It may be a very healthy relationship which you are in firm control of, or it might be a toxic relationship, in which you're always spending more than you earn. Either way, it's very healthy to take a good, hard look at what you do with the funds you have. It will help you see patterns, some good, some bad.

Let me tell you a quick story about a former client. A very nice young couple attended a first time homebuyer class that I conducted, wherein I told a true story about another former client who had been a barista at a large retail coffee chain. This coffee chain employee had been in the management-trainee program, and in one of her meetings she learned that the "average spend" for a customer of this coffee chain was $350/mo., or $11.67/day in a 30-day month. Now, this was before the Covid Pandemic, about 8 years ago, so imagine what that amount would be today!

So the couple attending my homebuyer class went home, decided not to change their spending habits, but also to monitor what they were spending each month. Two months later they called and exclaimed "You've ruined our trips to "XYZ" Coffee! We kept track, and we were spending almost $400/mo.! So now we've bought our own espresso machine, and we make our own coffee each day, and we're saving about $300/mo.!" Think about that - $300/mo., or $3,600/yr. That's a lot of money that they hadn't realized they were spending.

Simple stuff? Sure, but it boggles my mind how many people I speak to who haven't gone through this kind of exercise. And it's one of the easiest things to do. It just takes a legal pad and pencil, maybe a calculator, maybe an app on your phone - just something that will help you figure out where your money is going. And it's the first step to financial health, and to owning your own home.