Budgeting #2 - Where Do You Want to Be?

SMART Goals. Two weeks ago we reviewed the first question financial planners will ask you, which is "Financially speaking, where are you now?" And of course, that's the same place to start when you're planning on buying a home. After all, if you're going on a trip, you need a point of beginning, right? Seems simple enough. And once you have your beginning point, naturally you'll need to know your destination before you can decide how to get there.

Most people answer pretty vaguely when I ask them things like "What price range do you want to be in?", or "How much of a down payment are you prepared to make?", or "Do you have liquid assets to cover the down payment, closing costs, and prepaid expenses?", or "How soon do you want to move?". When I say "vague", I don't mean that in an insulting way at all. It's just that most people want to buy a home at some point in the future, but they haven't yet thought out all the necessary steps along the way to accomplish that goal. And this is where I borrow heavily from financial planners - in fact, I don't just borrow from them, I plagiarize them shamelessly! Let me explain.

If I were to ask you today "Financially speaking, where do you want to be?", you might answer "I want to pay off my debts, save a down payment, and buy a house in the next five years". And while most people would say that's a pretty good answer, financial planners will tell you it's not a good answer at all. They would say it doesn't "have any real teeth". Here's why.

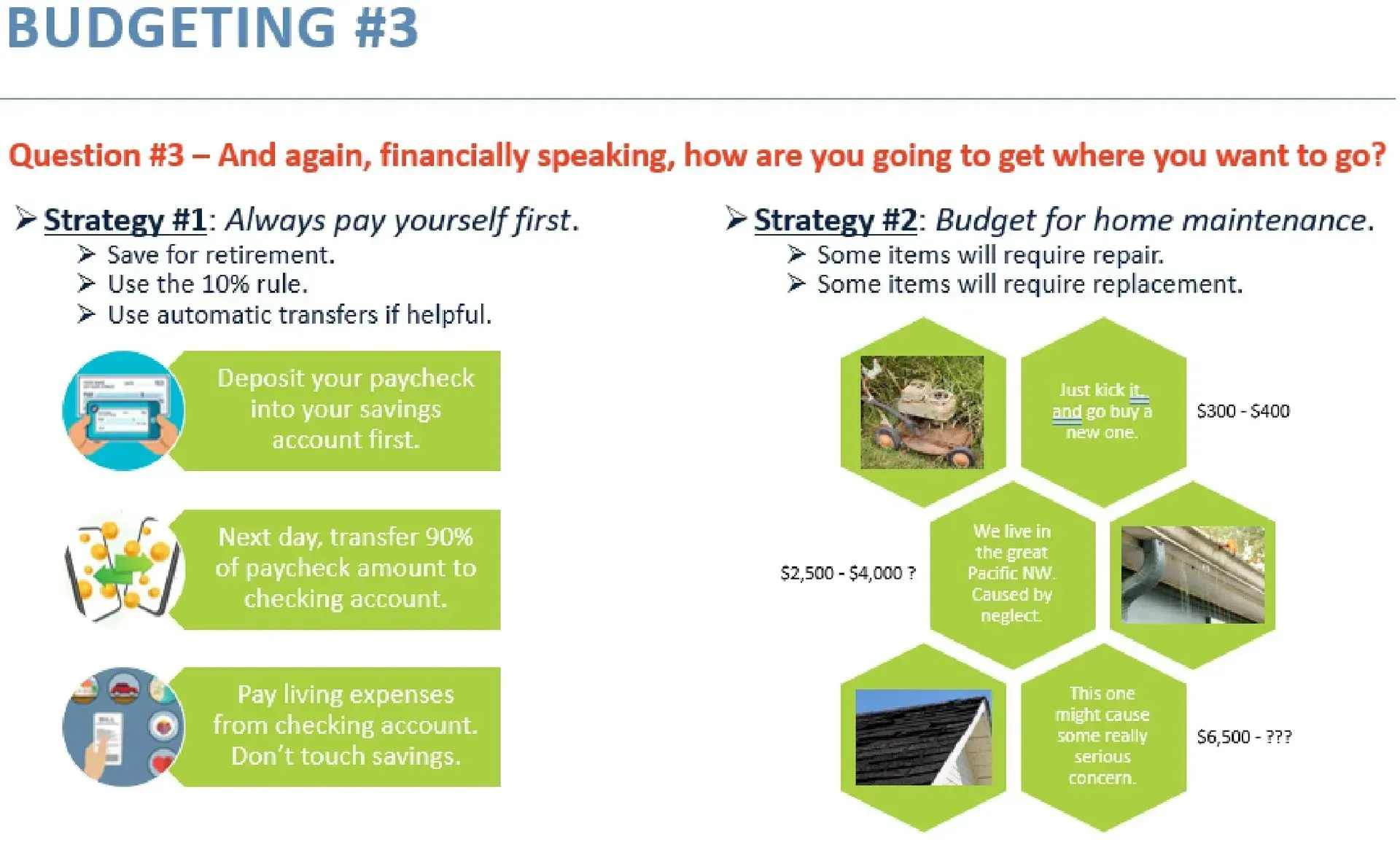

Financial Planners will say you need to set a SMART goal instead, and say something like "I want to pay off my credit cards, save a 3% down payment for a $600,000 home, have $5,000 left in the bank for a rainy-day fund, and I want to do this by two years from today." Can you see the difference? A SMART goal is (1) specific, (2) measurable, (3) attainable, (4) relevant, and (5) time-based. It has some real criteria built in by which you can measure your progress steadily and consistently. And you'll reach your goal a lot faster if it's a SMART goal!

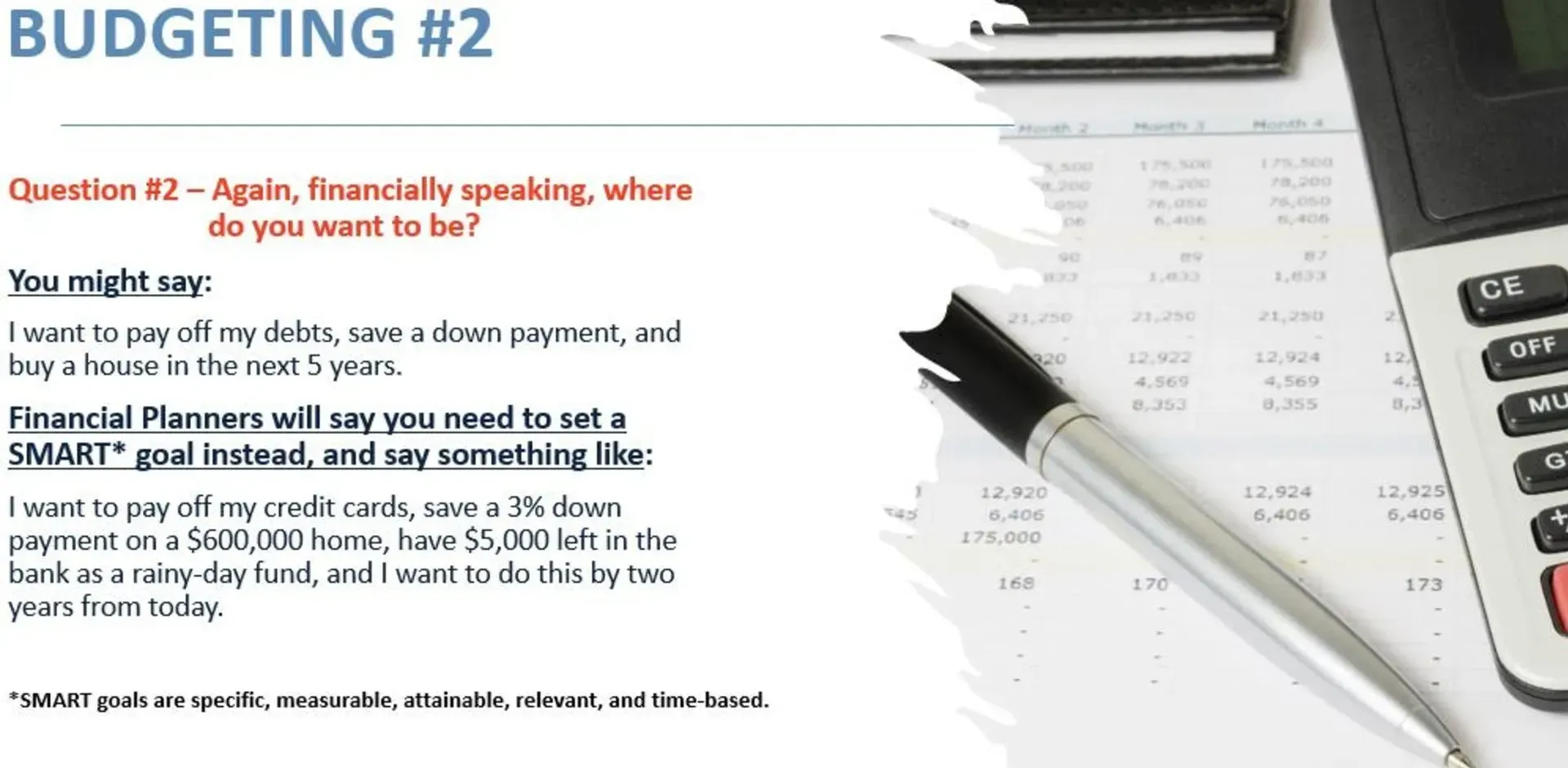

Helping prospective homebuyers develop goals to purchase a home is a lot of what I do. I've been doing it for many years, and I'd love to help you with it as well. If you're interested, just reach out to me in whatever way and time works best for you. And please be sure to stop by for next week's blog as well, when we'll talk about the third question financial planners ask, and how it will help you reach your goals to purchase a home.