Budgeting #3 - More Questions Financial Planners Will Ask You as You Prepare to Purchase a Home

Now that you know where you are financially, as well as where you want to be financially, the next question becomes "How are you going to get there? In the last couple of blog posts, we’ve been dealing with the questions Financial Planners ask prospective clients, which just happen to be exactly the same questions that a good real estate broker and a good mortgage broker should be asking.

The first question, “Where are you, financially speaking?” is simple enough. After all, everyone has to start somewhere. And it really doesn’t matter where you are when you start, it just matters that you start!

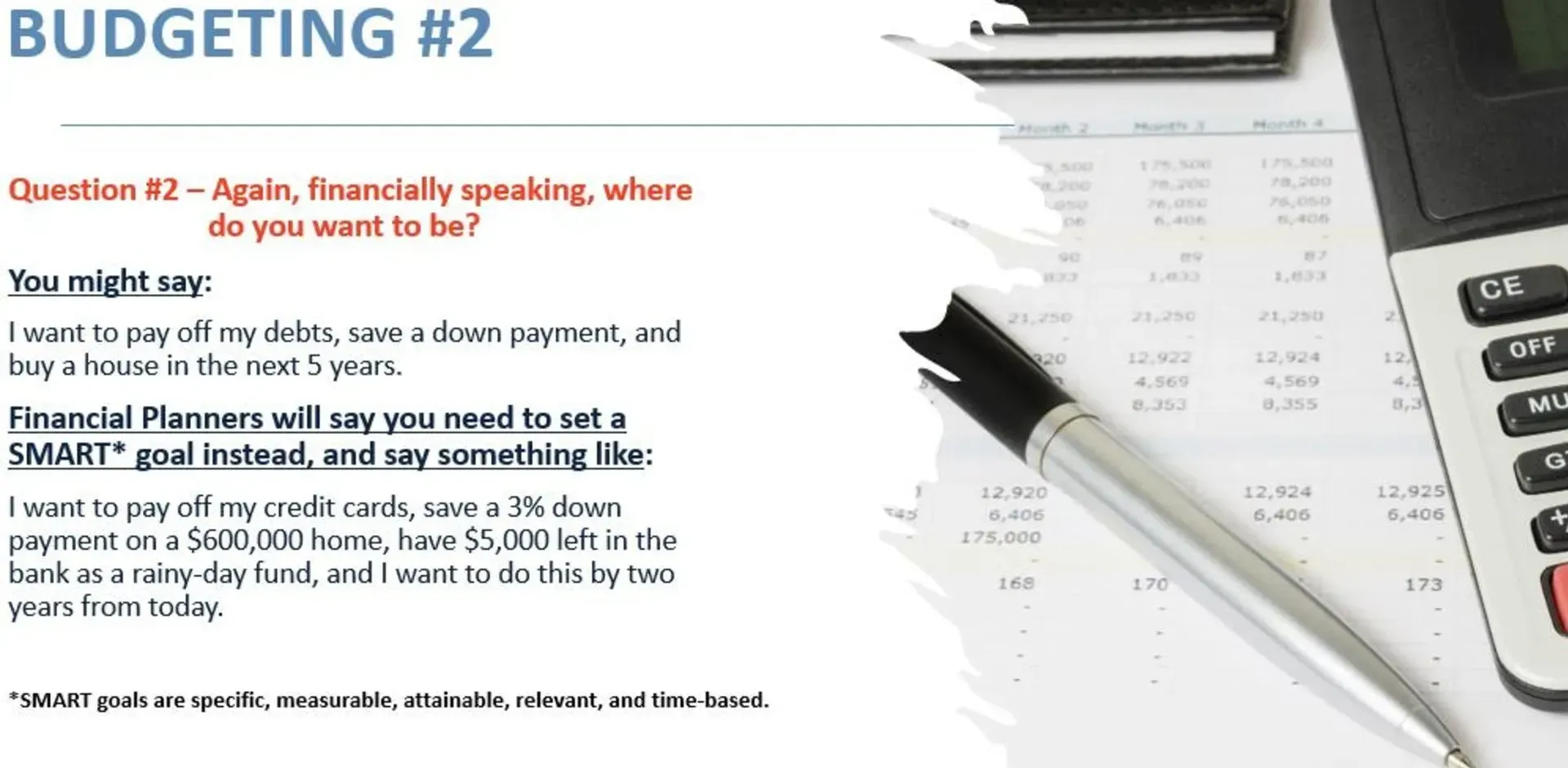

The second question, “Financially speaking, where do you want to be?” is the logical follow-up, but sometimes it’s a little difficult to be specific with your answer. And I would add that I don’t believe “specific” is enough…I think you should get down to the bottom of the barrel, the ticky-tacky, nitty-gritty, hard core truth of the matter, and get face-to-face with where you really want to go. Be VERY specific with your answer, using the acronym S.M.A.R.T. Because if you really want to accomplish your financial goals, they should be specific, measurable, attainable, relevant, and time-based.

Once you’ve answered the second question, it’s time to get on to the third question, which is “How are you going to get there?” You have to create your road map, right? Unfortunately, it’s not as simple as asking Siri or Alexa how to go from point A to point B, but once you have that S.M.A.R.T. goal firmly in your head and written down on paper, the job of figuring out how to accomplish it becomes much easier. It usually involves some behavioral changes for most people. This can be problematic for many, but Financial Planners and Mortgage Brokers have developed some simple strategies to help you do just that. Let’s deal with the first two strategies today.

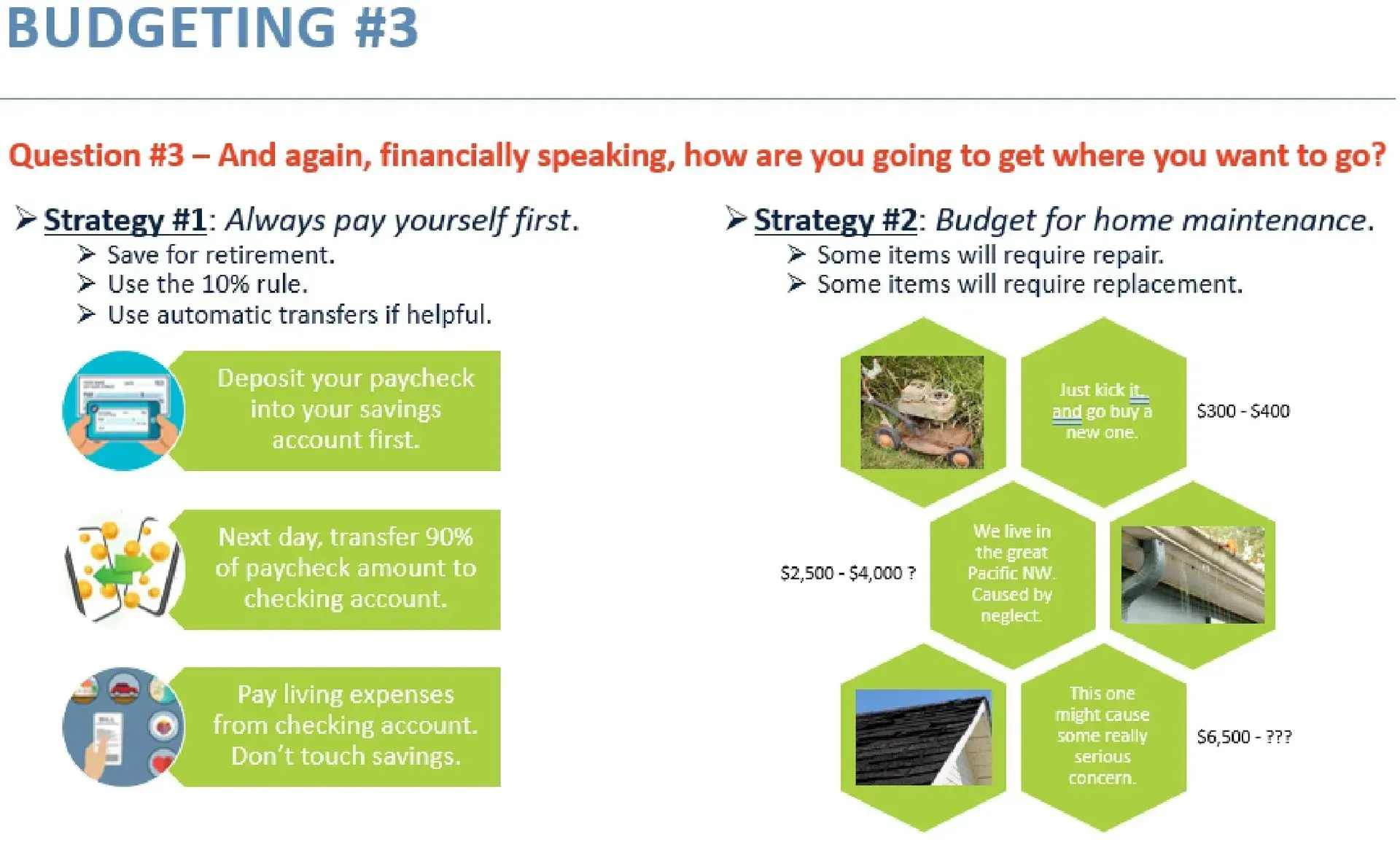

Strategy #1 is really simple - Always pay YOURSELF first. OK, you earn a certain amount on your job, and your employer takes out various taxes, social security, etc., before they give you your actual paycheck. You may have rent, utilities, credit card payments, car payments, etc. that you need to pay each month. But unless you set aside a little for your retirement every time you get paid, your retirement years may be pretty bleak. Financial Planners suggest that you should set aside 10% of your income toward retirement, but it might be hard for you to discipline yourself to do that. So just have your paycheck auto-deposited in your savings account. And when that money shows up in your savings account, transfer 90% of it into your checking account. Live off of what's in checking, and DON'T TOUCH YOUR SAVINGS ACCOUNT! If you set this up so that it's done automatically by your employer and your bank, it's a lot easier to accomplish.

Strategy #2 is to put a line item in your budget for home maintenance, and save a little money each month toward that. You may not own a home yet, but that doesn't matter. Get started doing it now, and you'll already have a little nest egg built up when you do purchase that first home. Look, I live in the Pacific Northwest portion of the U.S., and we get a lot of rain up here. And no matter whether I'm driving through a neighborhood that's priced for first time homeowners, or a neighborhood where the average price exceeds $3,000,000, I see the same three things all the time. I see old, rusted out lawn mowers sitting beside the garage, rain gutters and downspouts that are overflowing and rusty, and roofs with curled up edges on the shingles.

Now you might not be concerned about replacing a lawn mower. They're maybe... What - $300-$500 at the store? That might not pose a problem for you. But what about replacing damaged gutters and downspouts, that start out at around $3,000-$4,000 for a typical home in my neck of the woods? And if you need to have an old roof removed and a new one installed, it can run anywhere from about $8,000-$80,000! Maybe even more, depending on the size of your home, and the complexity of your roof design. Are you ready for that?

Please understand, I'm not saying these things will happen to you. But - they might. And if they do, I want you to be ready for them. I want you to be able to say "I've got this", and be able to sleep at night. If you have any questions about any of this, please feel to reach out to me whenever is convenient for you, via phone, text, or email. Remember, I don't work 9-5, I work start-to-finish. Come back again next week, and we'll deal with Strategies #3 and #4.